As GST completes eight years in India, it’s clear that this reform has moved from being an aspirational overhaul to becoming the foundation of India’s indirect tax system. However, it still remains a work in progress—especially for MSMEs, compliance-heavy sectors, and digital adoption.

Let’s reflect on what has worked, what needs to improve, and where GST is headed.

Major Achievements in 8 Years:

1. Unified Taxation Across India

The most obvious benefit—India is now a common market, free from interstate VAT barriers, CST complexities, and entry taxes.

2. Increase in Revenue Collection

GST has consistently delivered robust monthly revenues:

- ₹1.57 lakh crore collected in May 2023

- ₹1.87 lakh crore in April 2024 – highest monthly record

- Tax buoyancy has improved without increasing rates in most sectors

3. Digital Transformation in Compliance

India’s tax administration has become largely paperless:

- Over 95% of filings are digital

- E-invoicing and e-way bills have improved transparency

- Refunds and registration are now automated

4. Improved Tax Base and Formalization

- More than 1.4 crore registered taxpayers

- Unorganized sectors now fall under the tax net due to input credit dependencies

- E-commerce suppliers and inter-state service providers brought under compliance

5. Input Tax Credit Mechanism

Despite legal complexities, ITC remains one of GST’s strongest features in reducing cascading taxes and improving business margins.

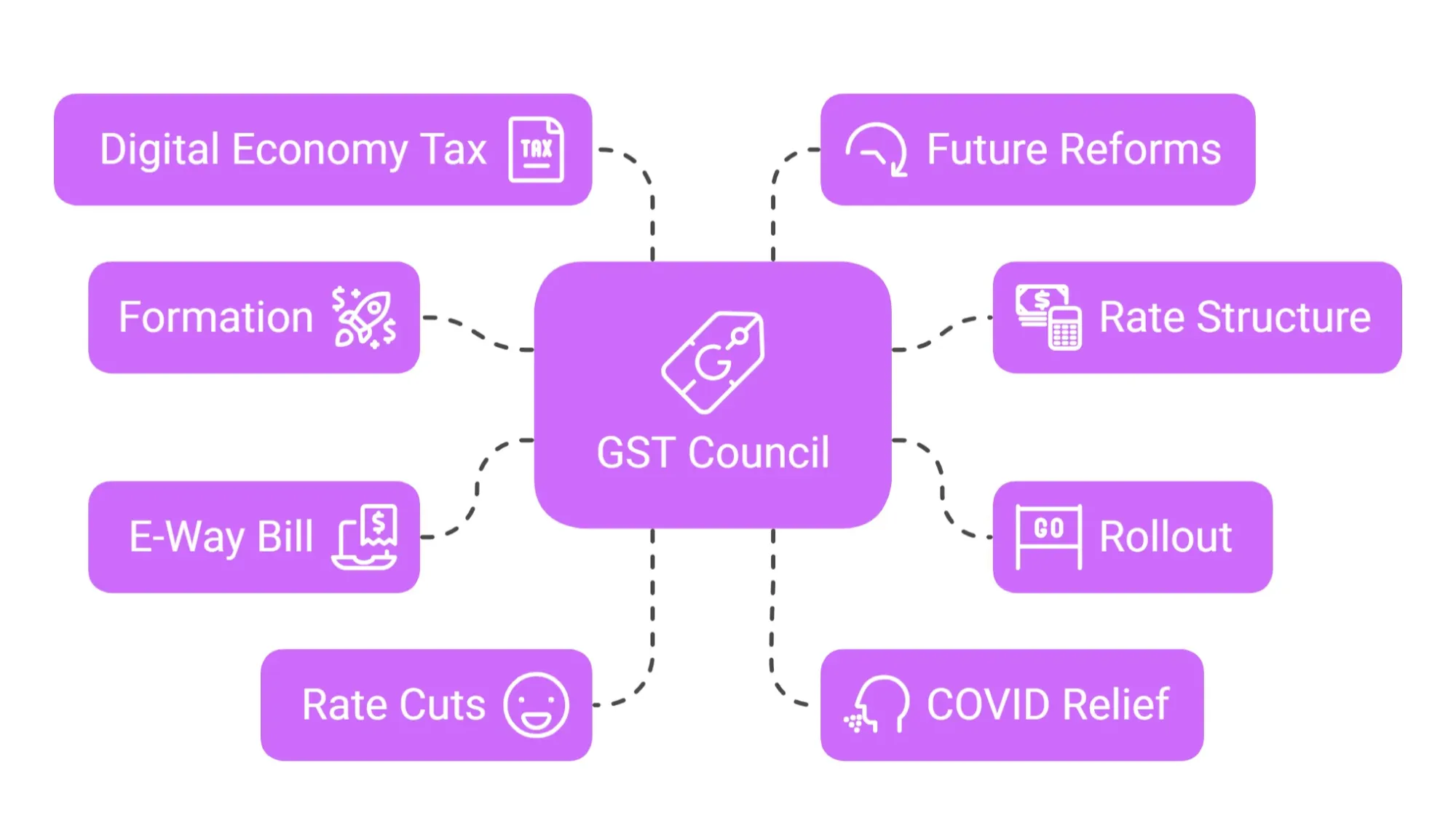

6. Cooperative Federalism

GST Council has met over 55 times with zero voting disputes, relying entirely on consensus—even during politically charged sessions.

7. Support for MSMEs

Through simplified schemes like:

- Composition scheme

- Quarterly Return Monthly Payment (QRMP)

- Threshold exemption enhancements

- E-way bill relaxations

…the GST regime has tried to address MSME needs (though challenges remain).

8. Anti-Evasion and Tech Monitoring

Use of data triangulation (GSTR-1 vs 3B vs 2B), e-invoicing, and analytics has reduced evasion and fake invoicing.

📌 Example: Linking GST with FASTag, ICEGATE, DGFT, and RBI has improved import/export monitoring.

| Sector | Benefit | Challenges | Overall Impact |

| MSMEs | Unified registration, digital refunds | High compliance, refund delays | ⚖️ Mixed |

| Manufacturing | Seamless movement, ITC chain | Classification, job work rules | ✅ Positive |

| Traders | Uniform pricing, ITC access | RCM burden, digital filing | ⚖️ Mixed |

| Exporters | Zero-rated exports, refund mechanism | Delays, working capital issues |

✅ Positive

|

| Charities/NGOs | Exemptions for core services | Unclear treatment of ancillary services | ⚠️ Uncertain |

| Logistics |

Reduced border delays, FASTag integration | Compliance for multi-point billing | ✅ Positive |

Table 1.2 GST 8 Year Scorecard.

GST in 2030: What Needs to Happen?

To realize the full potential of GST, the following reforms should be prioritized over the next five years:

1. Rate Rationalization

Move towards 3 slab structure (5%, 15%, 28%) and resolve inverted duty anomalies.

2. Inclusion of Petroleum and Alcohol

Bring high-revenue items under GST to complete the input tax chain and prevent cascading.

3. Operationalize GST Tribunal

Launch the appellate forum and introduce an amnesty scheme before it goes live.

4. Simplify Returns

- Eliminate redundant forms (e.g., GSTR-1, GSTR-1A)

- Enhance auto-population and editable returns

- Single quarterly return with monthly payments for small taxpayers

5. Clear ITC Rules

- Clarify grey areas like employee health insurance, free supplies, canteen input, and slump sale under GST

- Enable cross-jurisdiction ITC adjustments through centralized settlement

Watch this exclusive webinar from experts to know more!

GST’s Path Forward. Hear from experts:

As a GST consultant who has seen this regime evolve from its earliest days, here’s my takeaway:

- GST has worked well at scale: collections are high, evasion is lower, and digitization is embedded.

- But for MSMEs, traders, and manufacturers, it’s still an ongoing project with several complexities to iron out.

- The future must prioritize rate rationalization, legal clarity, tribunal functionality, and smart compliance.

Need a GST Filing Solution That Grows With Your Business?

Try floTax — India’s trusted ASP & GSP platform for end-to-end GST compliance.

- File GSTR-1, 3B, 9C with zero stress

- Seamlessly manage e-invoicing, reconciliation, and input tax credit

- Custom-built for MSMEs, manufacturers, and tax consultants

👉 Book Your Free Demo: marcom@wepsol.com