Brought to you by :

- floTax by Wepsol – A complete one-window solution for GST, E-Invoice, E-wayBill, Tax reconciliation.

In our recent webinar, Akella Prakasa Rao delved into an exciting development in the world of GST—the new Invoice Management System (IMS). This system promises to streamline invoice handling for Indian traders but also comes with its unique set of challenges. Explore how this new system aims to simplify processes while addressing the practical issues businesses face today.

Akella Prakasa Rao is an indirect tax advocate with over 27 years of experience across government, consultancy, and industries. He holds a BITS Pilani engineering degree and an LLB gold medal from Andhra University.

Listen now on YouTube.

Why is effective invoice management so important?

Well, it helps you stay compliant with tax rules, minimizes disputes, and maximizes your Input Tax Credit (ITC). With the complexity of transactions and the risk of mistakes, having a smooth way to handle invoices is crucial for the health of your business.

Contents :

- What is the Invoice Management System (IMS)?

- The Need for IMS

- Key Features of IMS

- Workflow of the IMS

- Understanding GSTR-2B and Its Relation to IMS

- Key Points on IMS

1. What is the Invoice Management System (IMS)?

So, what exactly is the Invoice Management System? Simply put, it’s a new feature in the GST platform designed to help taxpayers like you manage incoming invoices better.

Definition and Purpose of IMS

The main goal of the IMS is to make it easier for you to correct and amend invoices. With this system, you can accept, reject, or keep invoices pending —all in one place. This means fewer headaches when dealing with invoice mistakes and ensures that only the right invoices count toward your ITC.

2. The Need for IMS

Now, let’s talk about why we really need the IMS.

2.1 Challenges Faced by Taxpayers Regarding Invoice Corrections and Amendments

In the past, fixing mistakes on invoices has been a major hassle. Errors could lead to compliance issues, denied ITC claims, and disputes with suppliers. It’s been tough, which is why we needed a better way to manage invoices.

2.2 Importance of Accurate Input Tax Credit (ITC) Matching

Getting ITC matching right is super important for your business. If there are mismatches between what your suppliers issue and what you keep on record, it can mess up your ITC claims and impact your cash flow. The IMS helps you check incoming invoices easily, ensuring that only accepted ones go toward your ITC.

2.2 The Role of IMS in Improving the ITC Ecosystem

Selecting the best GST return filing software and GST filing services will make a big difference in IMS for a big step forward in making the ITC system work better. By giving you the tools to verify and manage invoices, we can promote more transparency and accuracy in tax reporting. This not only helps you as a taxpayer but also strengthens the entire GST compliance system.

3. Key Features of IMS

Now that we understand what the Invoice Management System (IMS) is and why it’s needed, let’s look into some of its key features that make it a best GST filing services software for taxpayers.

3.1 New Communication Process

One of the standout features of the IMS is its ability to facilitate better communication between taxpayers and suppliers. With this new process, both parties can easily discuss and resolve any invoice-related issues, making the entire transaction smoother. Whether you need clarification on an invoice or want to notify a supplier of a mistake, the IMS makes communication straightforward and efficient.

3.2 Actions Available for Recipients

The IMS provides taxpayers with three critical actions they can take on incoming invoices: Accept, Reject, or Keep Pending. Here’s how these actions work:

- Accept: When you accept an invoice, it means you are confirming its accuracy. Accepted invoices are then considered in your GSTR-2B for Input Tax Credit (ITC) purposes.

- Reject: If there’s an issue with an invoice, you can reject it. This action has implications for your ITC, as rejected invoices won’t count toward your credit claims.

- Keep Pending: If you need more time to verify an invoice, you can keep it pending. This allows you to take future actions based on your findings or any supplier responses. This helps mark invoices as pending for a later review.

Each of these actions has specific timelines tied to the GSTR filings, ensuring that you stay compliant while managing your invoices.

4. Workflow of the IMS

Understanding how the IMS works can help you navigate as GST solution more effectively.

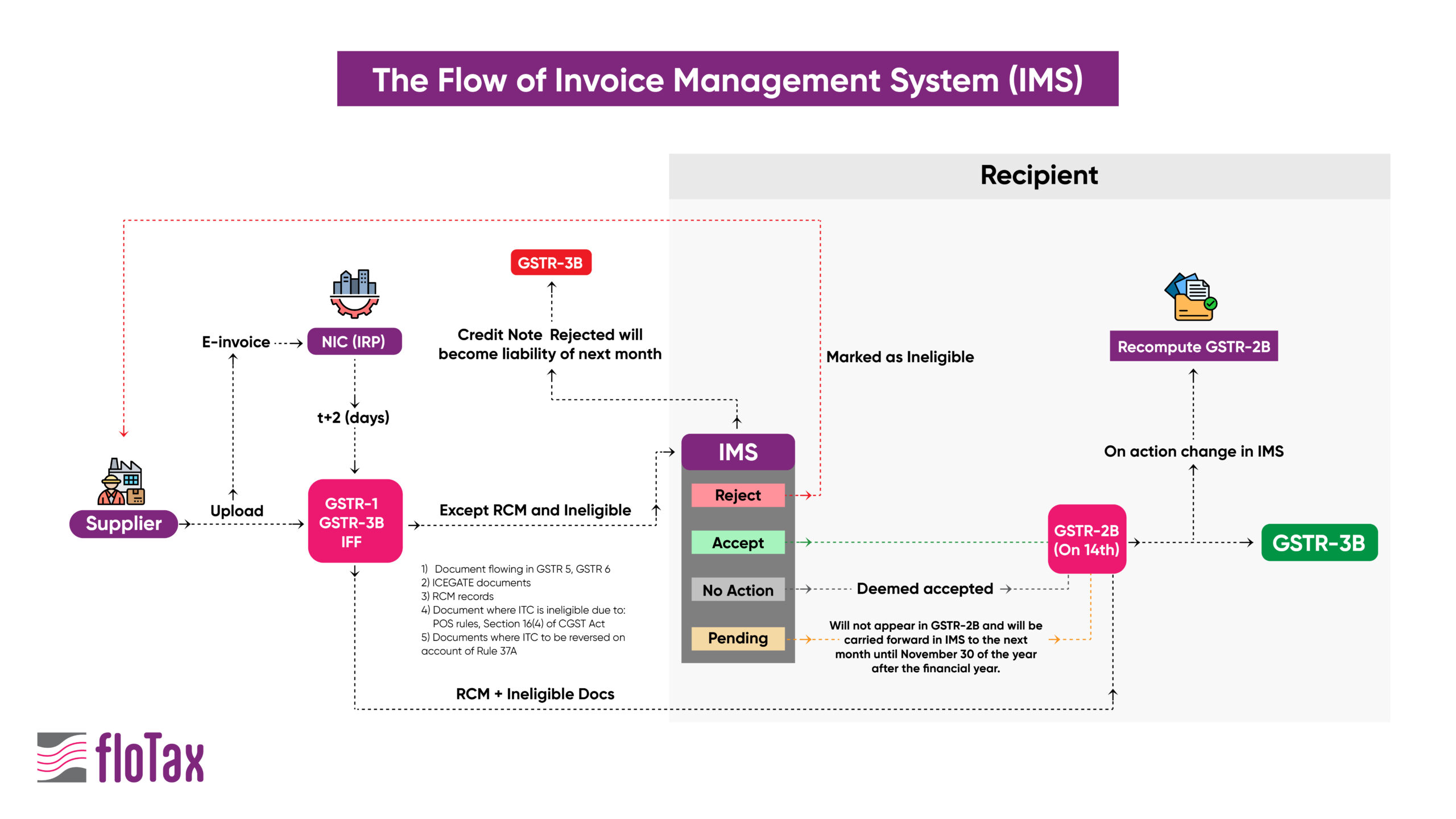

4.1 Flow of Invoices to IMS

When suppliers file their GSTR-1 or IFF (Invoice Furnishing Facility), their invoice records flow directly into the IMS. This smooth connection ensures that all relevant invoices are readily available for you to manage. Additionally, GSTR-1A records also populate the IMS, creating a comprehensive view of all incoming invoices.

4.2 Invoice Actions and Their Impact

Your actions on invoices have direct consequences, especially concerning your GSTR-2B:

- Accepting Invoices: When you accept invoices, they become part of your GSTR-2B, which is crucial for calculating your ITC.

- Rejecting Invoices: If you reject an invoice, it won’t appear in your GSTR-2B, meaning you won’t be able to claim ITC on that particular transaction.

- Pending Invoices: Keeping invoices pending means they will not be included in your GSTR-2B until you take further action. It’s essential to follow up on these to avoid missing out on potential credits.

5. Understanding GSTR-2B and Its Relation to IMS

To fully appreciate how the IMS functions, let’s explore GSTR-2B and its connection to invoice management.

5.1 Generation of GSTR-2B

GSTR-2B is generated monthly and reflects your eligible ITC based on accepted invoices. The timeline for generating GSTR-2B is tied to the filing of GSTR-1 by your suppliers. This means you need to keep an eye on your suppliers’ filing schedules to ensure you’re aware of your eligible credits.

5.2 Impact of Actions on GSTR-2B

Every action you take on invoices through the IMS directly affects your GSTR-2B. For example:

- Accepting an invoice will increase your eligible ITC.

- Rejecting an invoice will decrease it.

- Keeping an invoice pending means it won’t affect your credits until you take action.

Being proactive with your invoice management can significantly influence your cash flow and compliance status.

6. Key Points on IMS

Let’s highlight some essential points about the IMS:

6.1 Deemed Acceptance of Invoices

There’s an important concept called deemed acceptance. If you do not take any action on an invoice within a specified time, it may be considered accepted in GSTR-2B. This means you could unintentionally end up with an invoice that you didn’t approve!

6.2 Importance of Recomputing GSTR-2B

Sometimes, you may need to recompute your GSTR-2B. This can happen if there are changes to invoices or if you’ve taken actions that affect your ITC eligibility. Keeping your GSTR-2B up to date is crucial for accurate tax reporting.

6.3 Exemptions from IMS

Lastly, not all supplies go through the IMS. Certain transactions may bypass it and go directly to GSTR-3B. Understanding which supplies are exempt can help you manage your invoices more effectively.

Read here to explore how floTax’s new IMS features for managing your bulk invoices in a simplified system.