The Goods and Services Tax Appellate Tribunal (GSTAT) represents a critical component of India’s indirect tax dispute resolution framework. Established under the Central Goods and Services Tax Act, 2017, this specialized authority addresses GST-related disputes at the appellate level. With recently appointed leadership and newly implemented procedural rules, the GSTAT is poised to significantly streamline tax litigation processes across the country.

To address this critical gap and streamline the resolution of GST disputes, the establishment of the Goods and Services Tax Appellate Tribunal (GSTAT) was envisioned under Section 109 of the CGST Act. After several years of deliberations and overcoming various challenges, including objections from states regarding the structure and composition, and legal challenges concerning the eligibility of members, significant progress has been made towards making the GSTAT functional.

1. Understanding the GST Appellate Tribunal

1.1 Foundation and Legal Status

The GSTAT has been constituted by the Government of India under section 109 of the Central Goods and Services Tax Act, 2017, to hear various appeals under the CGST Act and respective State/UT GST Acts. The tribunal functions as a specialized appellate forum focused exclusively on matters relating to indirect taxation under the GST regime.

1.2 Composition and Structure

The GSTAT features a tiered structure to ensure accessibility and efficiency:

- National Bench: Located in New Delhi, comprising the President (Head), a Judicial Member, and two Technical Members (one from the state and another from the Centre).

- Principal Bench: Located in Delhi, serving as the administrative headquarters.

- State Benches: 31 benches across various states to handle region-specific disputes.

The National Bench primarily addresses issues related to the place of supply, while regional and state benches handle appeals within their specific jurisdictions.

1.3 Membership Eligibility Criteria

The GSTAT maintains strict eligibility requirements to ensure qualified adjudicators:

- President: Must be a Supreme Court judge or have served as a High Court Chief Justice.

- Judicial Member: Must be a High Court Judge or have served as an Additional District Judge or District Judge for at least 10 years.

- Technical Member (Centre): Must be an Indian Revenue Service member belonging to Group A or must be a member of All India Service with three years of experience in administering GST in the Central Government.

- Technical Member (State): Must be a state government officer or All India Service officer with rank above Additional Commissioner of Value Added Tax; also must have completed twenty-five years in Group A Services with three years administering GST or finance and taxation in the State Government.

This composition balances judicial expertise with technical knowledge in tax and finance matters, ensuring comprehensive evaluation of complex GST disputes.

The primary purpose of establishing the GSTAT is to ensure uniformity in dispute redressal across the country and enable the quicker resolution of cases.

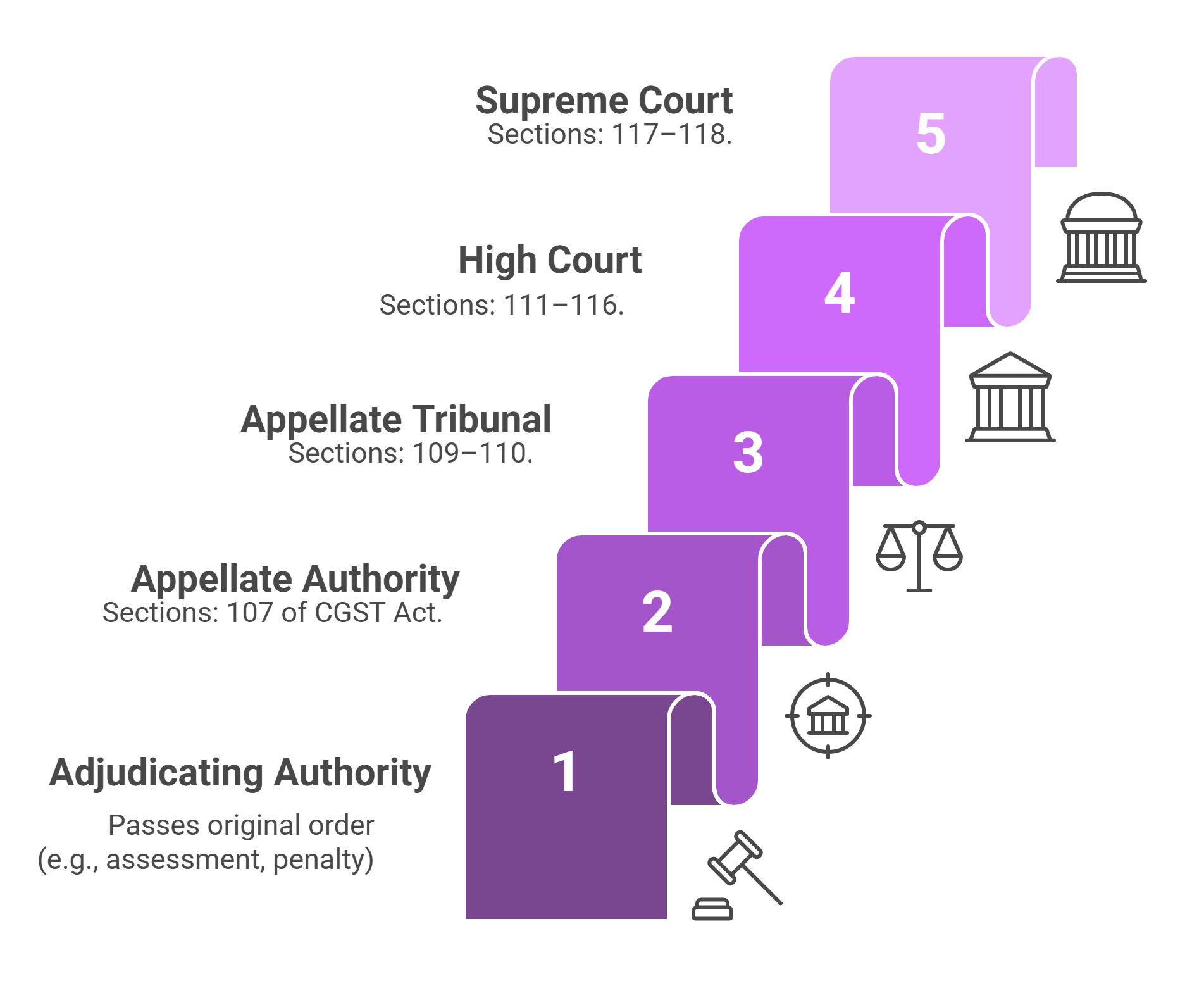

The appellate structure under GST typically proceeds as follows:

- Jurisdictional Officer (Adjudicating Authority)

- Appellate Authority (Commissioner Appeals/Joint Commissioner Appeals)

- GST Appellate Tribunal (GSTAT)

- High Court (on questions of law, from State Bench orders)

- Supreme Court (from Principal Bench orders or High Court judgments)

1.4 Composition and Structure

The GSTAT is structured with a Principal Bench located in New Delhi and numerous State Benches across various states and Union Territories. The Principal Bench is headed by a President, who is a Judge of the Supreme Court or a past/present Chief Justice of a High Court. It also includes a Judicial Member and two Technical Members (one from the Centre and one from the State). The State Benches consist of two Judicial Members and two Technical Members (one from the Centre and one from the State). The Principal Bench is intended to hear matters related to the place of supply, while State Benches handle appeals within their specific regions.

The Tribunal is empowered to hear appeals against orders passed by the Appellate Authority or the Revisional Authority. It is also authorized to adjudicate or examine cases related to anti-profiteering under Section 171 of the Act.

2. GSTAT Procedure Rules, 2025 (the gstat rules 2025)

2.1 Comprehensive Framework

The GSTAT Procedure Rules, 2025 establish a structured and technology-enabled framework governing all aspects of tribunal functioning. The Rules are organized into fifteen chapters, each addressing specific procedural elements:

A crucial step towards making the GSTAT operational was the notification of the GST Appellate Tribunal (Procedure) Rules, 2025 by the Ministry of Finance. These rules became effective from April 24, 2025. ****Framed under Section 111 of the Central GST Act, the rules provide a detailed framework with 124 provisions across 15 chapters, covering various aspects of the appeal process.

Key features of the GSTAT Procedure Rules, 2025 include:

- Mandatory Online Filing: via the GSTAT portal using standardized forms (GSTAT Form-01 for appeals, Form-06 for applications)

- Digital Orders and Communication: All final orders are digitally signed and uploaded to the GSTAT portal. The system is also designed to handle electronic service of notices and communication.

- Paperless and Digitized Process: The entire appeal process is intended to be paperless and digitized, streamlining filing and administration.

- Case Management: The rules outline procedures for case tracking using a Case Information System and Document Management System.

- Hybrid Hearings: The system provides the facility for hybrid hearings, allowing parties to opt for either physical attendance or electronic participation from a remote location.

- Evidence Submission: Specific procedures are detailed for submitting affidavits, summoning documents, examining witnesses, and presenting additional evidence, which typically requires prior permission from the tribunal.

- Powers of the Tribunal: The Tribunal is not bound by the strict rules of the Code of Civil Procedure, 1908, but follows the principles of natural justice and can regulate its own procedure. It possesses powers similar to a civil court for matters like summoning individuals, demanding documents, receiving evidence on affidavits, and issuing commissions for witness examination. Orders can be enforced as court decrees.

- Adjournment: The Tribunal can adjourn the hearing of an appeal for a maximum of three times, with reasons recorded in writing.

- Amendment of Orders: The Tribunal can amend its own orders within three months to rectify apparent mistakes. Any amendment increasing tax liability requires providing a reasonable opportunity of being heard.

The introduction of these rules is expected to create a transparent, efficient, and accessible appellate system for GST disputes.

2.2 Revised Monetary Limits and Pre-Deposit Requirements

The 53rd GST Council Meeting (June 2024) rationalized litigation thresholds:

| Appeal Type | Previous Pre-Deposit | Revised Pre-Deposit |

|---|---|---|

| Appellate Authority | ₹25Cr (CGST/SGST) | ₹20Cr (CGST/SGST) |

| GSTAT | 20% (Max ₹50Cr) | 10% (Max ₹20Cr) |

These changes aim to reduce frivolous litigation while ensuring revenue protection14. Taxpayers must formally notify proper officers of their intent to appeal within three months of the tribunal’s operationalization

2.3 Digital Transformation

The Rules emphasize technological integration, with provisions for :

- Electronic filing of appeals through prescribed forms (FORM GST APL-05).

- Issuance of provisional and final acknowledgments electronically.

- Hybrid hearing capabilities to enhance accessibility.

- Digital record-keeping and management systems.

This digital focus aims to streamline processes, reduce paperwork, and enhance accessibility for appellants across the country.

“The appeal process is not just a right, it’s a safeguard to ensure justice in taxation.”

3. Appeal Process and Procedures

3.1 Eligibility for Filing Appeals

Appeals can be filed by:

- Taxpayers dissatisfied with First Appellate Authority decisions.

- Department representatives when deemed necessary by the Commissioner.

3.2 Timeframes for Filing

Strict statutory timeframes govern the appeal process:

- For taxpayers: Within three months from the date of communication of the order being appealed against.

- For department: Within six months from the date of communication of the Order-in-Appeal17

The tribunal has the power to condone delays in filing appeals by taxpayers up to three months and cross-objection up to 45 days if sufficient cause is demonstrated.

3.3 Financial Requirements

Appellants must meet specific financial obligations:

- Payment of prescribed appeal fees

- Deposit of disputed amount (20% of the tax, fine, interest, and penalty from the original order)

3.4 Documentation and Filing Process

The procedural requirements include:

- Electronic submission of appeal in FORM GST APL-05 with relevant documents.

- Receipt of provisional acknowledgment immediately upon submission.

- Submission of certified copy of the appealed order within seven days.

- Issuance of final acknowledgment with appeal number after scrutiny.

- Filing of any cross-objections in FORM GST APL-06.

In cases where electronic filing is not feasible, the Registrar may permit manual submission through special orders.

4. Recent Developments and Significance

4.1 Leadership Appointments

As of May 5, 2024, the Centre has appointed retired Justice Sanjaya Kumar Mishra as the President of the GSTAT. This marks a significant step in operationalizing the tribunal across the country.

4.2 Procedural Amendments

Recent amendments introduced through GST Notification 12/2024 have updated Rules 110 and 111 and introduced a new Rule 113A, enhancing the appeal process mechanisms. These changes further clarify the procedures for filing appeals and applications.

4.3 Impact on Tax Dispute Resolution

Since its inception following the 2017 GST implementation, the GSTAT has:

- Disposed of thousands of appeals

- Helped shape uniform GST jurisprudence across jurisdictions

- Enhanced accessibility through regional and state benches

- Reduced the need for litigants to travel to New Delhi.

4.4 Comparative Analysis with Pre-GST Regime

The transition from VAT tribunals to GSTAT introduced several improvements:

| Parameter | VAT Era | GSTAT Framework |

|---|---|---|

| Jurisdiction | State-specific | Pan-India standardization |

| Member Expertise | Tax-focused | Judicial + Technical |

| Appeal Timeline | 12-18 months | 30-day adjudication post-hearing |

| Transparency | Limited public access | Daily cause lists online |

This structural overhaul has reduced average disposal time from 583 days (pre-2023) to a projected 180 days under the new rules.

5. Benefits and Significance

The establishment and operationalization of the GST Appellate Tribunal holds significant promise for improving the GST ecosystem and the broader business environment in India.

The key benefits and significance include:

- Faster Dispute Resolution: GSTAT is expected to drastically reduce the pendency of GST cases and facilitate their faster disposal. The law suggests a target of resolving appeals within one year.

- Reduced Burden on High Courts: By providing a specialized appellate forum, GSTAT will significantly alleviate the caseload on High Courts, which have been handling a large number of GST writ petitions in the tribunal’s absence.

- Specialized Expertise: The Tribunal members are expected to possess specialist knowledge and experience in GST laws, leading to more informed, consistent, and fair decisions compared to general courts.

- Cost-Effectiveness: Approaching the GSTAT is anticipated to be a more cost-effective alternative to litigation in High Courts, benefiting taxpayers.

- Uniformity and Consistency: As a common forum for both Central and State GST disputes, GSTAT will play a crucial role in ensuring uniform interpretation and application of GST laws across the country.

- Enhanced Ease of Doing Business: A transparent, efficient, and timely dispute resolution mechanism is vital for improving the ease of doing business environment in India. GSTAT contributes directly to this by providing a clear path for resolving tax disputes.

- Clarity in Tax Law: The orders and decisions rendered by the GSTAT will contribute to developing jurisprudence and providing clarity on various complex aspects of GST law.

- Opportunities for Professionals: The large number of benches and anticipated volume of cases present significant opportunities for tax professionals, consultants, and lawyers specializing in GST litigation.

Conclusion

The GST Appellate Tribunal represents a landmark advancement in India’s indirect tax appellate system. Through its comprehensive procedural rules, specialized composition, and technology-enabled operations, the GSTAT aims to provide efficient, transparent, and accessible dispute resolution services to taxpayers and the government alike. As it continues to evolve and establish precedents, the tribunal will play a crucial role in shaping GST jurisprudence and ensuring uniformity in tax interpretation across India. For businesses and tax professionals, understanding the GSTAT structure and processes is essential for effective navigation of the GST dispute resolution landscape.

Read here to explore how floTax’s features help you meet your GST compliance and managing your GST filing in a simplified system.

Need assistance with GST Compliance? Contact floTax for expert guidance and support in implementing your GST process.

Reach us at marcom@wepsol.com