India’s taxation landscape is set to enter a new era. Eight years after the historic rollout of the Goods and Services Tax (GST) in July 2017, the government has announced the most significant upgrade yet GST 2.0

Effective September 22, 2025, GST 2.0 has been positioned not just as a rate rationalization exercise, but as a strategic policy reorientation. Prime Minister Narendra Modi, while unveiling the reform package, called it a “new chapter in India’s tax history” — one that aims to simplify compliance, lower household costs, and stimulate broad-based economic growth.

GST was meant to be good and simple, But has it felt that way?

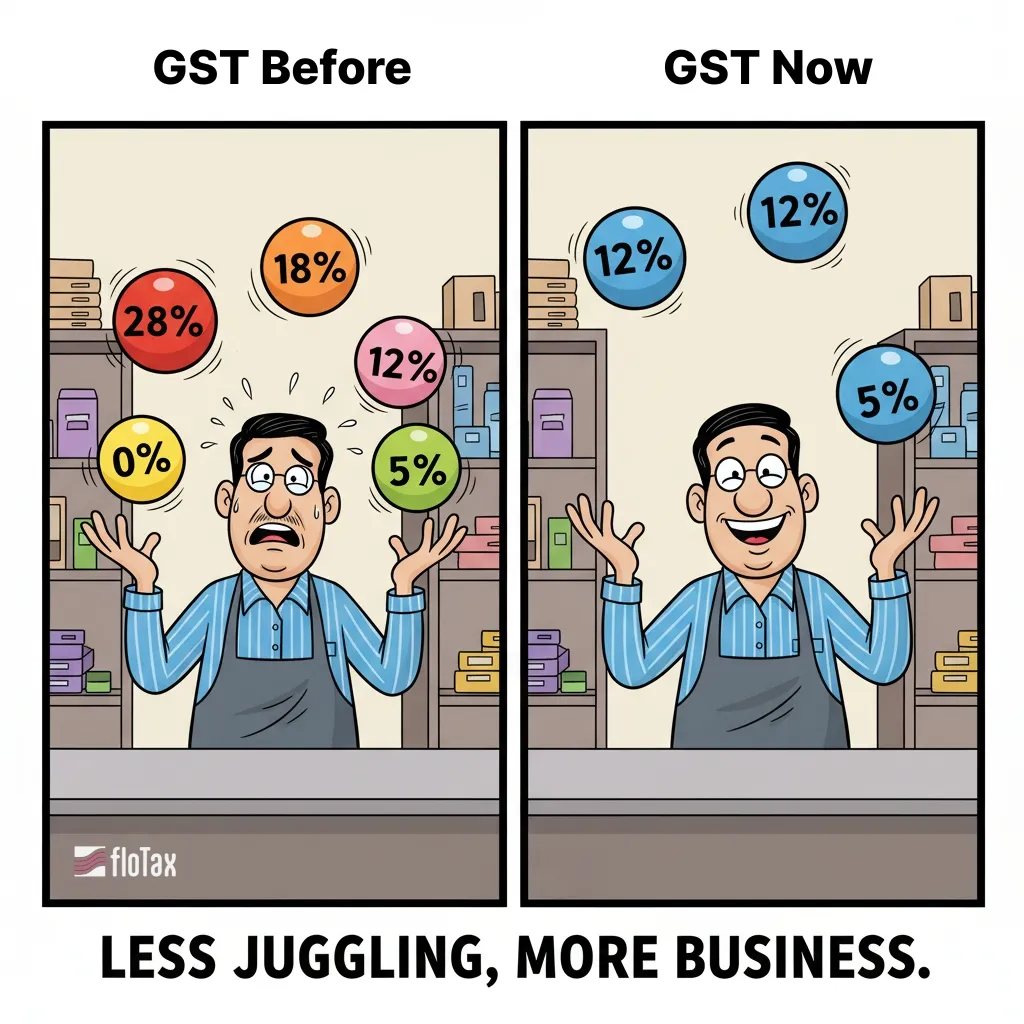

- After years of patchwork fixes and sectoral adjustments, GST had become cluttered with multiple slabs, frequent disputes, and procedural complexities.

- Businesses, especially MSMEs, voiced concerns over compliance burdens, cash-flow blockages, and litigation.

- Consumers felt the pinch of high taxes on essentials, healthcare, and housing inputs.

- States sought clarity on revenue-sharing, and courts were choked with unresolved GST disputes.

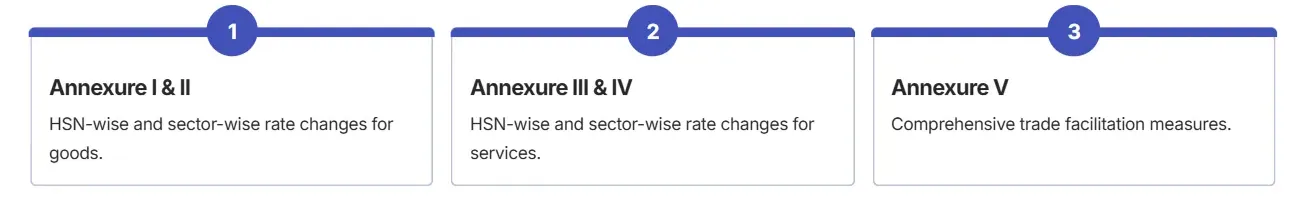

Decisions from the 56th GST Council Meeting

The 56th GST Council Meeting (Sept 3–4, 2025) broke nearly nine months of policy silence with a sweeping reform package. Key decisions included:

- Rate Rationalization: The four-slab system (5%, 12%, 18%, 28%) replaced with two main slabs (5% & 18%) plus a de-merit 40% rate for sin/luxury goods.

- Trade Facilitation: Streamlined registration, faster refunds, clearer place-of-supply rules, and post-sale discount clarity.

- Institutional Strengthening: Operationalization of GSTAT and creation of the National Appellate Authority for Advance Rulings (NAAAR).

- Technology Upgrades: Expansion of e-invoicing, AI-powered compliance, and pre-filled returns.

- Transitional Support: FAQs and guidelines for invoices, ITC, and refunds during the shift.

Industry observers hailed it as a “reset button for GST”, balancing ease of living, ease of doing business, and fiscal stability.

The Pillars of GST 2.0

GST 2.0 is structured around three foundational pillars:

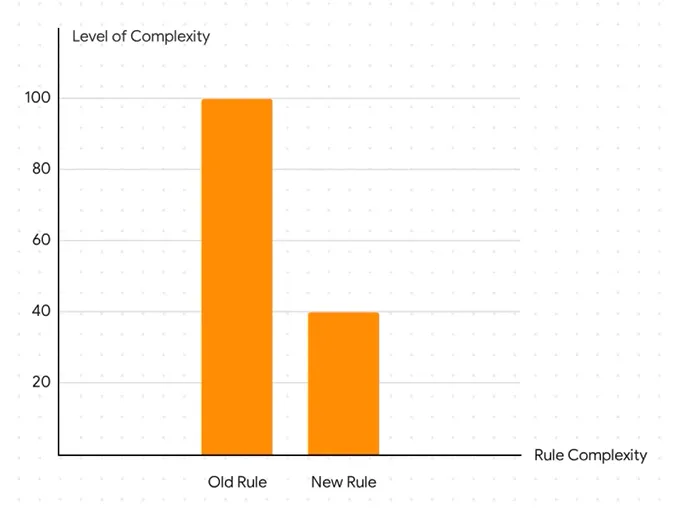

- Structural Reform: Simplifies rates and classification, reducing litigation and compliance complexity.

- Rate Rationalization: Cuts taxes on essentials, healthcare, housing, and manufacturing while taxing sin and luxury goods higher.

- Ease of Living: Focuses on households — life and health insurance exemptions, lower taxes on daily goods, and affordable healthcare.

Rate Rationalization: A Landmark Shift

The new GST framework simplifies taxation and reduces household costs:

Impact Highlights:

| Rate Category | GST Rate | Coverage |

|---|---|---|

| Merit Rate | 5% | Essentials, packaged foods, household items, agricultural inputs, medicines |

| Standard Rate | 18% | Electronics, automobiles, construction materials, most services |

| De-Merit Rate | 40% | Sin goods (tobacco, pan masala, gutkha) and luxury items |

Impact Highlights:

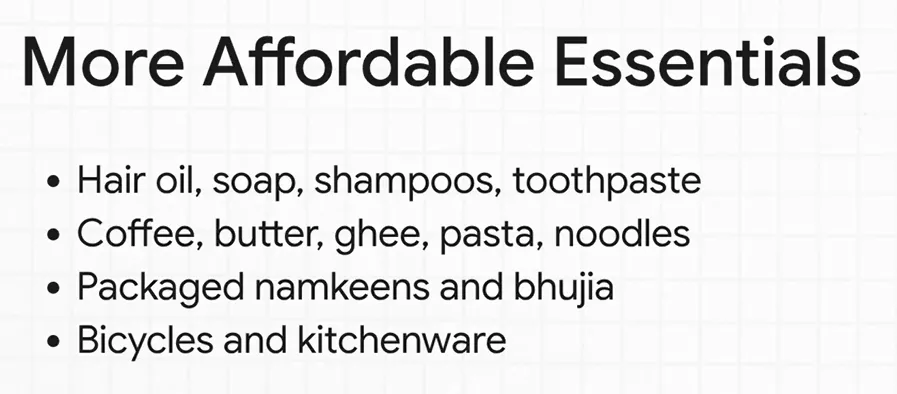

- Households: Lower taxes on soaps, packaged foods, medicines; life & health insurance now GST-exempt.

- Automobiles: Small cars & two-wheelers at 18%; luxury vehicles at 40%.

- FMCG & Consumer Durables: Price drops support festive demand and manufacturing.

- Housing & Construction: Cheaper cement, marble, and construction materials aid real estate revival.

- Textiles: Resolving inverted duty structures enhances domestic and export competitiveness.

- Services & Hospitality: Hotels (<₹7,500/day), gyms, salons, and wellness services now at 5%, boosting employment.

Facilitation Measures for Trade

Beyond rates, GST 2.0 eases compliance:

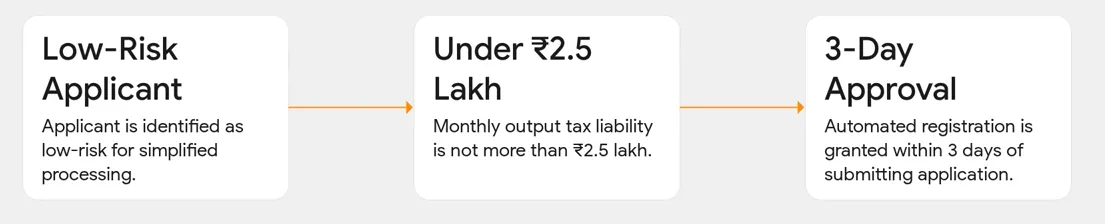

- Simplified Registration: Fast-track approval for low-risk businesses; separate mechanism for e-commerce vendors.

- Expedited & Risk-Based Refunds: 90% provisional refunds for zero-rated supplies and IDS claims; automated system processing.

- Post-Sale Discounts: Simplified rules allow credit-note adjustments without pre-supply agreements.

- Clarity on Place of Supply: Intermediary services default to recipient location, easing export compliance.

- Practical Reporting: Auto-drafted returns (GSTR-2B) and reconciliation alerts reduce errors.

Goods-Related Amendments

1. RSP-Based GST Levy: GST will now be levied on the Retail Sale Price (RSP) for products like Pan Masala, Gutkha, Cigarettes, Unmanufactured tobacco, and Chewing tobacco (e.g., Zarda), moving away from transaction value-based assessment.

2. Ad Hoc IGST Exemption: An ad hoc exemption from IGST and compensation cess has been granted for a new armoured sedan imported by the President’s Secretariat for the President of India.

Service-Related Amendments

1. Restaurant Services Clarification: Explanations have been added to the ‘specified premises’ definition to clarify that standalone restaurants cannot claim this designation, preventing them from availing the 18% GST option with ITC.

2. Lottery Valuation Alignment: Amendments to GST Valuation rules are being undertaken to align with changes in tax rates applicable to lottery tickets, ensuring consistency in tax computation.

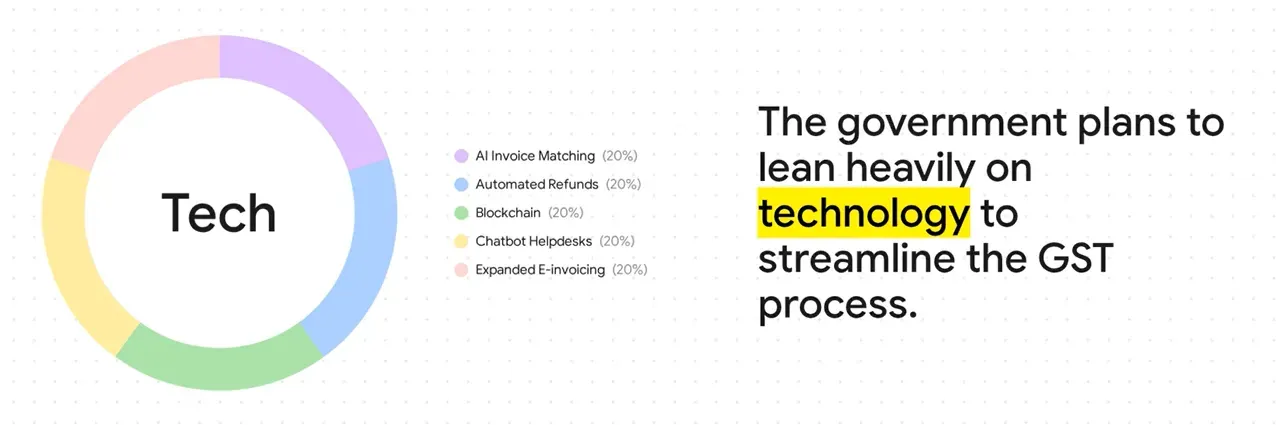

Technology Upgrades in GST 2.0

Technology is central to GST 2.0’s vision:

- E-Invoicing: Mandatory for businesses >₹2 crore turnover; reduces fake invoicing and simplifies ITC claims.

- Pre-Filled Returns: System auto-populates GSTR-1 & GSTR-3B, minimizing errors.

- AI-Powered Monitoring: Detects anomalies, fraud, and high-risk taxpayers; reduces audit burden on compliant businesses.

- Blockchain (Proposed): Immutable transaction records for transparency.

- Automated Helpdesks: 24/7 AI chatbots for queries; system-driven refunds.

Strengthening Institutions & Legal Framework

- GSTAT: Dedicated appellate tribunal to resolve ~40,000 disputes quickly.

- NAAAR: National-level authority to unify advance rulings, reducing multi-state conflicts.

- RSP Levy on Sin Goods: GST based on retail sale price to close valuation loopholes.

- Revenue Monitoring: AI-driven analytics to detect evasion, improve collections, and reduce leakage.

Strengthening Institutions & Legal Framework

- GSTAT: Dedicated appellate tribunal to resolve ~40,000 disputes quickly.

- NAAAR: National-level authority to unify advance rulings, reducing multi-state conflicts.

- RSP Levy on Sin Goods: GST based on retail sale price to close valuation loopholes.

- Revenue Monitoring: AI-driven analytics to detect evasion, improve collections, and reduce leakage.

Economic & Market Impact

- GDP: Projected +0.4% in FY26.

- Inflation: Expected easing of 30–50 basis points due to lower rates on essentials and housing materials.

- Fiscal Trade-Offs: ~0.3% of GDP revenue loss (Centre 0.1%, States 0.2%), offset by higher compliance and consumption.

- Markets: FMCG, consumer durables, and auto stocks rallied; bond yields may edge up due to short-term revenue loss.

- Sector Gains: Better rural consumption, competitive textiles exports, affordable automobiles, cheaper housing materials, and expanded insurance coverage.

Unresolved Issues under GST (Sept 2025)

Despite its scope, GST 2.0 leaves critical challenges:

- Auto Sector Cess: Dealers face stranded pre-reform cess credits (~₹2,500 crore).

- Online Gaming: Legal ambiguity on past and future taxation.

- Legacy IDS Refunds: Pending claims still block working capital.

- E-Commerce Delivery: New category for hyper-local logistics remains undefined.

- Other Issues: ITC denial for supplier defaults, SME compliance costs, and portal glitches persist.

Transitional Challenges (from Sept 22, 2025)

Businesses face operational hurdles:

- New tax rates applicable — all businesses must update systems.

- MRP labels to be re-stickered/re-labelled, leading to compliance costs.

- Accumulated ITC reversal required where goods are exempted.

- Contracts to be revisited to pass on tax benefits and avoid anti-profiteering scrutiny.

- Suppliers to be cautioned — rate benefits must flow downstream.

- Accumulated ITC encashment delays expected in case of rate reductions.

- Lower tax rate without ITC may hurt industry viability in some sectors.

- No IDS refund for services sector, which could create fresh disputes.

“GST 2.0 is not just a tax reform; it’s a strategic reset — simplifying compliance, empowering citizens, and fueling India’s growth story.”

GST 2.0 brings major opportunities — lower rates, faster refunds, and easier compliance — but also new challenges: system updates, ITC reconciliation, transitional adjustments, and managing multiple sector-specific rules. floTax is designed to help businesses navigate this complexity seamlessly.

How floTax supports GST management and automation?:

- Automated GST Filing & Reconciliation

- Real-Time Compliance Monitoring

- Sector-Specific Insights

- Trade Facilitation Support

- Technology-Driven Efficiency

Ensure your business is GST 2.0 ready. Contact us today and try floTax to automate compliance, simplify reporting, and gain full control over your GST obligations.

💡 Stay tuned to our Part 2 On detailed analysis of GST 2.0