Practical steps, sector-specific tactics, compliance checklists, and tools.

In Part 1 of The GST Revamp — CFO’s Strategic Playbook, we explored how India’s evolving GST regime demands a boardroom-level response from finance leaders, from proactive tax planning to governance frameworks that safeguard enterprise value.

Now, it’s time to move from strategy to execution.

This section is your hands-on GST transformation guide — packed with tools, sector-specific playbooks, compliance checklists, and real-world tactics to turn policy shifts into business advantage.

Let’s get tactical — and equip your finance team to lead GST transformation with precision and confidence.

1️⃣ CFO as Digital Enabler: Driving GST Transformation with Technology

The next wave of GST transformation is not just about new rules,

it’s about data-first decision-making, automation, and ERP alignment. As tax authorities shift toward AI-based scrutiny, CFOs must move from manual reconciliation to intelligent compliance systems that can detect anomalies, recommend corrective actions, and enhance visibility.

Automation & Reconciliation Tools

A strategic finance team can no longer rely on Excel-based processes for monthly reconciliation. Modern CFOs are deploying:

- AI-based GSTR 2A/2B vs 3B reconciliation engines

- Vendor compliance trackers

- Auto-alert systems for DRC-01C and 88C notices

ERP Integration: From Add-Ons to Native Intelligence

CFOs are embedding GST tools directly into their SAP, Oracle, and Tally environments to:

- Automate e-invoicing and credit reconciliation

- Ensure real-time invoice validation and reporting

- Pre-validate HSN/SAC codes and place-of-supply

2️⃣ Litigation & Audit Preparedness: Playing Offense, Not Just Defense

As GST scrutiny deepens, litigation preparedness becomes a board-level priority. CFOs must move beyond reactive handling of notices to building structured, evidence-backed governance frameworks.

Audit-Readiness Checklist for CFOs

✅ Maintain vendor communication logs (WhatsApp, emails)

✅ SOPs for GSTR 2B mismatches and reversals

✅ DRC-01C/88C response workflows

✅ Legal memos outlining tax position on grey zones (e.g., canteen credits, free samples)

✅ Advance ruling tracker for key scenarios

✅ Internal GST health check every 6 months

3️⃣Governance & Cross-Functional Training: Building a GST-Aware Enterprise

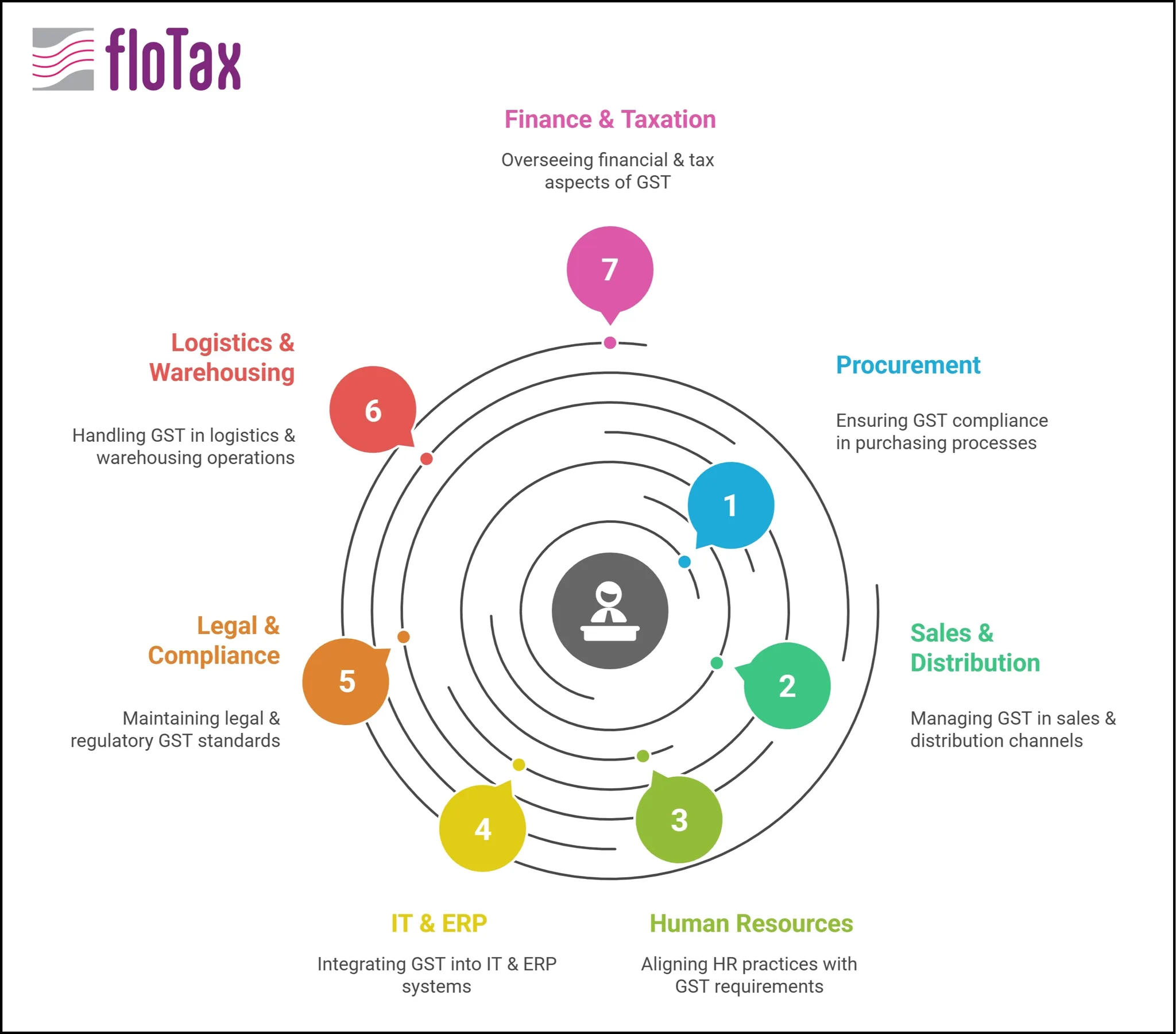

GST is no longer the tax team’s problem alone. It impacts:

- Sales teams (pricing, place-of-supply)

- Procurement (vendor grading, reverse charge)

- HR (employee reimbursements, canteen services)

- Logistics (e-way bills, delivery flows)

CFO’s Governance Framework

- Quarterly GST training for business teams

- Monthly compliance audits with red flags to CXOs

- Internal GST Playbook covering:

- RCM treatment

- HSN/SAC accuracy

- Common errors and mitigation

- Tax position memos

4️⃣ Strategic GST Opportunities Across Sectors: CFO View

GST compliance is not a one-size-fits-all obligation — sectoral nuances demand tailored CFO strategies. Let’s explore how strategic finance leaders in manufacturing, trading, and services are aligning GST to business growth.

4.1 Manufacturing Sector: Optimizing ITC and Workflow Efficiency

The impact of GST on manufacturing companies is two-fold:

- High volume of inward supplies → complex ITC cycles

- Capital goods and plant/machinery procurements → long-term credit planning

CFO Opportunities:

- Structure procurement contracts to align with ITC realization timelines

- Leverage advance ruling for capital-intensive projects (e.g., factory setup, tool imports)

- Automate ****e-invoicing integration with ERP to eliminate manual compliance gaps

📌CFO Tip: Monitor vendor ITC pass-through on every capex invoice — delay here can lock working capital for quarters.

4.2 Trading Sector: ITC Visibility & Pricing Intelligence

The impact of GST on traders in India is evolving due to:

- Reduced thresholds for e-invoicing

- Dependency on upstream vendor compliance

- Frequent classification disputes (goods vs. services)

CFO Opportunities:

- Establish auto-reconciliation checkpoints with key vendors

- Price products with place-of-supply rules and IGST vs CGST implications

- Train sales team to avoid non-compliant billing patterns (e.g., mismatched location billing under “bill-to, ship-to”)

4.3 Service Providers (Consulting, Trusts, NGOs, etc.)

GST on services continues to evolve, especially in:

- Charitable trusts and NGOs

- Wellness and education-based services (e.g., yoga, therapy)

- IT and software consulting with cross-border exposure

CFO Opportunities:

- Identify exempt vs taxable services (e.g., yoga therapy is exempt under certain definitions, but training courses may not be)

- Review GST rules for NGOs and Trusts to determine ITC availability

- Manage GST on services provided to charitable institutions — some may be taxable at standard rates if provided for consideration

5️⃣ Focus Areas CFOs Shouldn’t Overlook in 2025

Employee Health Insurance — Can You Claim GST Credit?

One of the most frequent CFO questions:

Can I claim GST input on employee group health insurance policies?

Answer: Only if mandated by law (e.g., Factories Act, Mines Act) — otherwise it is considered a “personal benefit” and input credit is restricted under Section 17(5).

💼 Implication: This non-creditable GST becomes a cost. CFOs must model the true effective cost of employee benefits and align procurement accordingly.

5.1 Industrial Canteens

- Canteen services provided to employees often fall in a grey zone.

- Unless the canteen is mandatory by statute, GST credit on canteen bills is typically not allowed.

✅ CFO’s Action: Structure vendor billing or employee contribution models to optimize GST treatment.

5.2 Free Goods and Promotional Offers

- As per GST law, free supply without consideration is taxable under Schedule I.

- Companies must issue invoice or delivery challan, even for promotional giveaways.

Treatment of Free Samples under GST:

- GST must be paid on supply of free goods.

- Input tax credit may need to be reversed, unless part of a composite/bundled supply.

💡CFO’s Strategy:

- Classify free items as part of combo packs (if applicable)

- Document internal memos with legal reasoning

- Align with Rule 42 and 43 ITC reversal calculations

6️⃣ Special Compliance: Slump Sale, FASTag, GSTR-9C, and More

6.1 Slump Sale and GST

A slump sale (transfer of a business unit for a lump sum) triggers GST only if it qualifies as a supply of goods or services.

✅CFOs must analyze:

- Whether “business transfer as a going concern” applies (exempt)

- Proper classification under GST Schedule II

- Agreement wording and valuation implications

6.2 E-Way Bill and FASTag Integration

- E-way bill integration with FASTag/RFID is being piloted across states.

- Mismatches between FASTag logs and e-way bill entries can trigger red flags.

6.3 GSTR-9C & Annual Filings

- Ensure audit reconciliation (GSTR-9C) is aligned with books and ERP records.

- CFOs must personally review sections prone to errors — credit reversals, stock-in-transit, etc.

✅ Checklist for CFOs:

- Cross-check turnover thresholds

- Review Section 17(5) reversals

- Map expense ledger vs credit claimed

Below are curated questions from real-time CFOs during the floTax webinar, answered by Srinivas Arya — veteran finance leader and former Group CFO, capturing actionable insights for senior finance teams.

During the Q&A session at the end of the video, the following questions were asked and answered:

❓ Q1: “How can a tax head become a CFO?”

Srinivas Arya:

To transition from a functional head to a company head, one must shift from a reactive to a proactive and strategic mindset. Key areas for development include:

- Financial Reporting: This includes IFRS, NDS, and the consolidation of accounts.

- Treasury Management: This involves managing cash flows, fundraising, working capital, and forex hedging.

- Controllership: This includes internal control, audits, and financial policies.

- Strategic Finance: This involves business planning, mergers and acquisitions, valuations, and investor relations.

❓ Q2: “What does a CFO’s calendar look like?”

Srinivas Arya:

Modern CFOs use technology to manage their calendars with updates and alarms. A typical quarterly plan might include:

- Quarter 1: Annual budget planning, GST audit planning, and ITC review.

- Quarter 2: Digital finance transformation.

- Quarter 3: Tax audits.

- Quarter 4: Year-end audit preparations.

❓ Q3: “Should taxation heads be part of every strategic decision in the CXO’s office?”

Srinivas Arya:

Yes, their participation is crucial for:

- Identifying tax-saving opportunities.

- Mitigating legal and compliance issues.

- Improving cash flow and fund flows.

- Enhancing organizational stability by addressing risk and reward.

- Structuring the supply chain for optimized procurement.

❓ Q4: “Is it necessary to be ready for litigation if we are transparent and well-documented with auditors?”

Srinivas Arya:

It depends. If documentation is transparent and explanations are clear, litigation can often be avoided. However, if there is evidence of bad intentions, it can lead to suspicion and potential litigation.

❓ Q5: “What are the ideal qualities of a CFO?”

Srinivas Arya:

A CFO should be able to integrate within and outside the organization. They need to be polite yet direct, strict with rules, and proactive in finding legal ways to conduct business.

❓ Q6: “How do you identify the correct CFO as a mentor?”

Srinivas Arya:

A mentor doesn’t have to be a CFO. It can be any senior colleague in finance who is approachable, accommodative, and patient.

❓ Q7: “How can one maintain a work-life balance in a CFO or CO role?”

Srinivas Arya:

It is important to set boundaries and maintain a disciplined routine. A fresh person working 8-10 hours can be more efficient than someone working 18 hours. While some periods may be demanding, it is crucial to prioritize family and aim for at least a 60/40 balance.

⚡Strategic Outlook: GST 2.0 and Beyond

The GST regime is shifting from compliance-checking to predictive, analytics-led governance. The next-gen features CFOs should prepare for include:

- AI-powered auto-reversals and risk predication

- Broader ITC-liquidity monitoring across multi‑state entities

- Blockchain‑based vendor authentication and crypto-linked invoices in pilot programs

- Integrated e‑way bill & FASTag data pipelines for logistics visibility

High-performing finance functions will:

- Develop GST risk dashboards and predictive tax forecasts

- Engage in scenario‑based modelling of ITC volatility

- Spearhead digital labs for pilot programs on emerging tax-tech

✅ Now you’re Ready To Transform GST Risk Into Strategic Advantage.

Transform GST Strategy into a Competitive Advantage with floTax

Ready to move beyond compliance and lead with confidence?

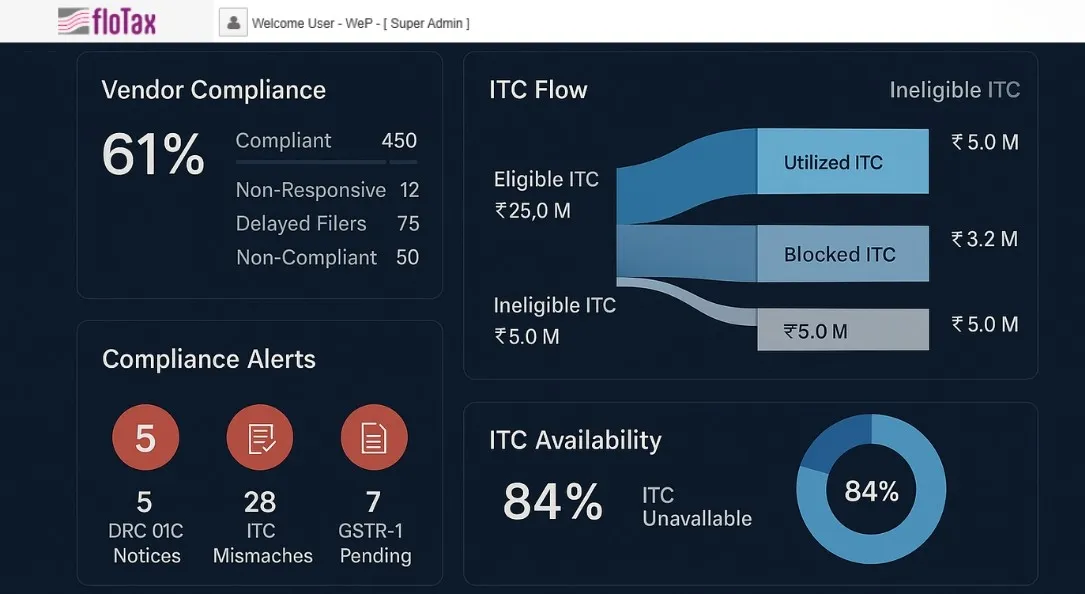

floTax empowers CFOs and finance teams with:

- Real-time GSTR-2B/3B reconciliation

- Automated vendor risk grading

- ERP-integrated dashboards for ITC tracking

- Smart workflows for DRC, 88C, and audit readiness

📞 Book a strategy demo with our team marcom@wepsol.com

🌐 Checkout more details on floTax here at https://wepsol.com/solutions/flotax/