July 1, 2025 — A Milestone Moment

On this day in 2017, India turned a major page in its economic history by launching the Goods and Services Tax (GST)—a single, unified tax intended to replace a tangled web of central and state levies.

Now, eight years later, it’s time to ask: Has GST delivered on its promise of being a “Good and Simple Tax”?

“GST is not just a tax reform; it is a business reform. It has fundamentally altered how India trades, manufactures, and consumes.

– CEA or CBIC official

In this blog, written from the lens of a GST expert and policy observer Mr. Akella Prakasa Rao—dives deep into:

The Pre-GST Era,

Before GST, India’s indirect tax system was a multi-headed hydra—fragmented, inconsistent, and often punishing to small businesses and manufacturers.

A Maze of Taxes:

- Central-level taxes: Excise Duty, Service Tax, CST

- State-level taxes: VAT, Entry Tax, Octroi, Luxury Tax, Entertainment Tax

- Cascading effect: No input credit across tax types (e.g., excise duty not creditable against VAT)

- Multiple registrations, returns, and audits for each state

“The tax-on-tax system inflated costs and discouraged interstate trade.”

–Indian Institute of Public Finance

For traders and MSMEs, the pain was even sharper:

- No seamless input tax credit (ITC)

- Tax arbitrage across states led to inefficiencies

- Compliance disproportionately favoured large enterprises

Why GST Was Inevitable?

- India’s GDP growth was stifled by inefficient logistics and tax layers

- Trade and industry demanded a unified tax framework

- The government envisioned “One Nation, One Tax” to simplify commerce, increase tax base, and digitize compliance

July 1, 2017: The Great GST taxation changes

With a midnight parliamentary launch, GST finally replaced 17 central and state taxes and 23 cesses with a dual structure:

India’s Dual GST Model

- CGST: Central share

- SGST/UTGST: State/UT share

- IGST: For inter-state supplies, shared based on consumption

This model balanced cooperative federalism with administrative simplicity.

GST Rate Slabs (as of 2025)

- 0%: Basic necessities

- 5%, 12%, 18%, 28%: Standard goods and services

- Other rates: 0.25% (diamonds), 3% (gold), 1–6% (composition scheme)

However, rate rationalization remains a work in progress. We’ll cover that later.

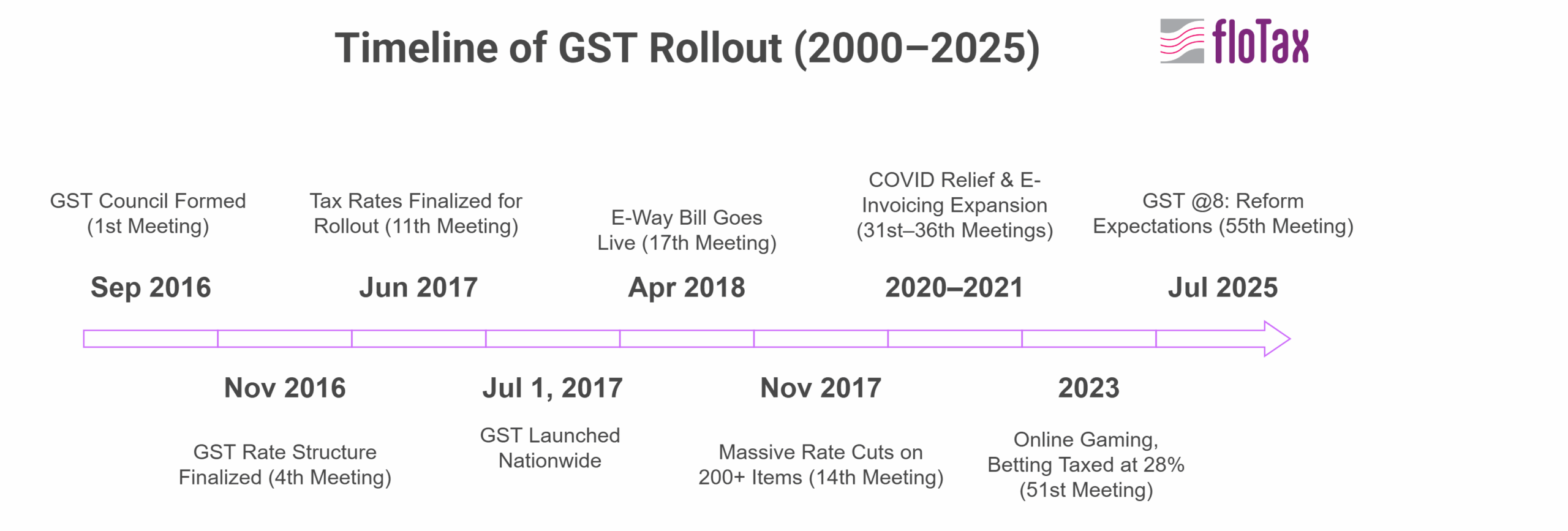

GST Council: Consensus-Driven Governance

A major innovation of GST is the GST Council, a constitutional body comprising Union and State Finance Ministers.

- 55 meetings held as of Dec 2024

- All decisions have been unanimous so far

- Council issues circulars, clarifications, and recommends rate changes

- Over 1.4 crore registered taxpayers

- Monthly collections consistently over ₹1.5 lakh crore

- More than 12,000+ notifications/circulars issued

GSTN Portal Interface + floTax dashboard preview

Source: https://wepsol.com/solutions/flotax/

Impact of GST on MSMEs, Traders, and Manufacturing Sector

The Goods and Services Tax was introduced with the goal of reducing complexity and creating a level playing field. However, the initial years posed significant compliance and liquidity challenges, particularly for MSMEs and small traders.

Impact on MSMEs and Small Traders:

1. Compliance Burden

While GST aimed to simplify taxation, in practice it introduced frequent return filing, complex input credit rules, and a need for digital literacy—challenges not all MSMEs were prepared for.

- Monthly returns (GSTR-1, GSTR-3B) increased paperwork

- Annual return (GSTR-9) and audit reconciliation (GSTR-9C) added compliance pressure

- Smaller firms without in-house finance teams had to rely on external consultants

“GST expects a trader in a Tier-2 town to operate like a corporate. That’s unrealistic without significant handholding.”

— An MSME Chamber

2. Liquidity Issues

The input tax credit mechanism was designed to reduce cost, but delays in refunds and credit mismatches led to working capital being blocked.

- Exporters and suppliers to SEZs often faced refund delays

- Mismatch in GSTR-1 and GSTR-2A/2B led to ITC denial

- Advance tax on goods created tracking burdens

GST and the Trading Sector

GST has significantly impacted traders—especially those engaged in interstate operations, small wholesale businesses, and unorganized retail.

Key changes:

- Mandatory registration for interstate supply, even if below threshold

- E-way bills needed for goods valued over ₹50,000

- Reverse charge mechanism (RCM) discouraged purchases from unregistered dealers

GST and Manufacturing Companies

The manufacturing sector benefitted from removal of entry taxes, CST, and multiple VAT regimes, which streamlined supply chains. However, compliance and classification issues remain key concerns.

Positive outcomes:

- Free movement of goods across states

- Uniform tax rates on raw materials and finished goods

- Reduced logistics costs with e-way bills

Pain points:

- Blockage of credit on capital goods and service inputs

- Confusion in HSN classification

- Litigation on valuation and job work rules

💻 Digital Transformation Under GST

Digitalization has been both a boon and a barrier. While it brings long-term benefits, many businesses initially struggled with technology adoption.

GSTN – The Digital Backbone

The Goods and Services Tax Network (GSTN) enables:

- Online registration

- Return filing and reconciliation

- Refund applications

- E-way bill generation

But during the initial years, portal downtime, slow UI, and frequent changes caused frustration among users.

|

Year

|

Milestone

|

Description

|

|---|---|---|

|

2017

|

GSTR Filing

|

GSTN Live, returns online

|

|

2018

|

E-Way Bill

|

Interstate goods movement

|

|

2019

|

Refund Automation

|

Online exporter refunds

|

|

2020

|

E-Invoicing 1

|

₹500 Cr+ businesses

|

|

2021

|

E-Invoicing 2

|

₹100 Cr+ + e-Way sync

|

|

2022

|

GSTR-2B Matching

|

Auto ITC draft + PAN link

|

|

2023

|

E-Invoicing for ₹5 Cr

|

Mass-scale adoption

|

|

2024

|

FASTag+RFID

|

Transport validation

|

|

2025

|

Full Sync (Expected)

|

Tribunal, AI recon

|

📄 E-Invoicing: A Game Changer

Introduced in phases from October 2020, e-invoicing is now mandatory for businesses with turnover above ₹5 crore (from Aug 2023).

Benefits:

- Seamless GSTR-1 auto-fill

- Reduced fraud through invoice matching

- Integrated with e-way bill generation

But initial adoption was slow due to,

- Lack of awareness

- Cost of updating ERP/accounting software

- Resistance from micro and small businesses

🚚 E-Way Bill Integration with FASTag and RFID

- Launched April 1, 2018

- Mandatory for movement of goods above threshold limits

- Integrated with FASTag/RFID to reduce road stoppage and check-post delays

GST Compliance and Input Credit Complexities

Employee Insurance and Medical Benefits

A recurring area of litigation is whether companies can claim GST input credit on employee health insurance or canteen expenses.

Current position:

- Input credit not available unless it is mandatorily required under any law (e.g., Factories Act)

- Often denied during audit or scrutiny

GST on Free Samples and Free Supplies

Another grey area involves free supplies and promotional schemes. Businesses often send:

- Free samples to distributors or doctors

- Buy-one-get-one offers

- Free gifts on festivals

GST Position:

- Invoice required even for free samples if supply is to a different GSTIN

- No ITC allowed on inputs used for free samples (as per Rule 17(5))

Bill-to-Ship-to Transactions

A common model in manufacturing and distribution:

- One party bills, another receives the goods

- Requires proper invoicing to determine place of supply and IGST vs CGST+SGST

Legal Challenges and GST Litigation Landscape

While GST aimed to simplify indirect taxation, its implementation has been mired in legal complexities, especially in areas of input tax credit (ITC), place of supply, free supplies, and classification.

The GST Tribunal: Still Not Operational

One of the biggest setbacks in dispute resolution under GST has been the non-functional GST Appellate Tribunal (GSTAT).

- Taxpayers aggrieved by departmental orders currently approach High Courts, which is not ideal for routine tax matters.

- As a result, thousands of GST-related writ petitions are pending across India.

Supreme Court Observations: Persuasive Value of Council

In Union of India vs. Mohit Minerals Pvt. Ltd., the Supreme Court ruled that the GST Council’s recommendations are not binding—only persuasive.

This led some states to deviate from Council recommendations in the name of revenue protection.

- Example: Delay in circular on fertilizer subsidy taxability

- Political ideology began influencing tax administration

Retrospective Amendments

Frequent retrospective legislative changes, especially related to ITC, RCM, and classification, have:

- Created uncertainty for businesses

- Scared foreign investors

- Complicated compliance planning

Sector-Specific GST Issues

GST on Charitable Trusts and NGOs

There’s widespread confusion about whether services provided by charitable trusts—like education, medical relief, or religious activities—are exempt.

Current Position:

- Services by charitable trusts for religious/yoga/healthcare are generally exempt

- However, services like canteens or donations linked to goods may attract GST

GST on Canteen and Employee Welfare Services

Many companies are now questioning whether they can:

- Claim input credit on expenses for industrial canteens

- Be liable to pay GST on nominal recoveries from employees

Clarifications so far:

- ITC allowed only if mandated by law (Factories Act, etc.)

- GST payable if the company recovers even a nominal fee

GST on Yoga and Training Services

- Yoga services offered by registered charitable trusts are exempt

- But ambiguity arises when services are branded or monetized through private platforms

Classification, Intermediaries, and “Cash” as a Thing

Several litigations relate to classification of goods/services, and definition of intermediary under Section 2(13).

- Disputes on ‘software vs SaaS’, job work vs manufacturing, intermediary vs export of service

- Even cash was questioned in court: Can cash be considered a “thing” under GST for seizure purposes?

These legal ambiguities highlight the need for clarity and consistency in GST enforcement.

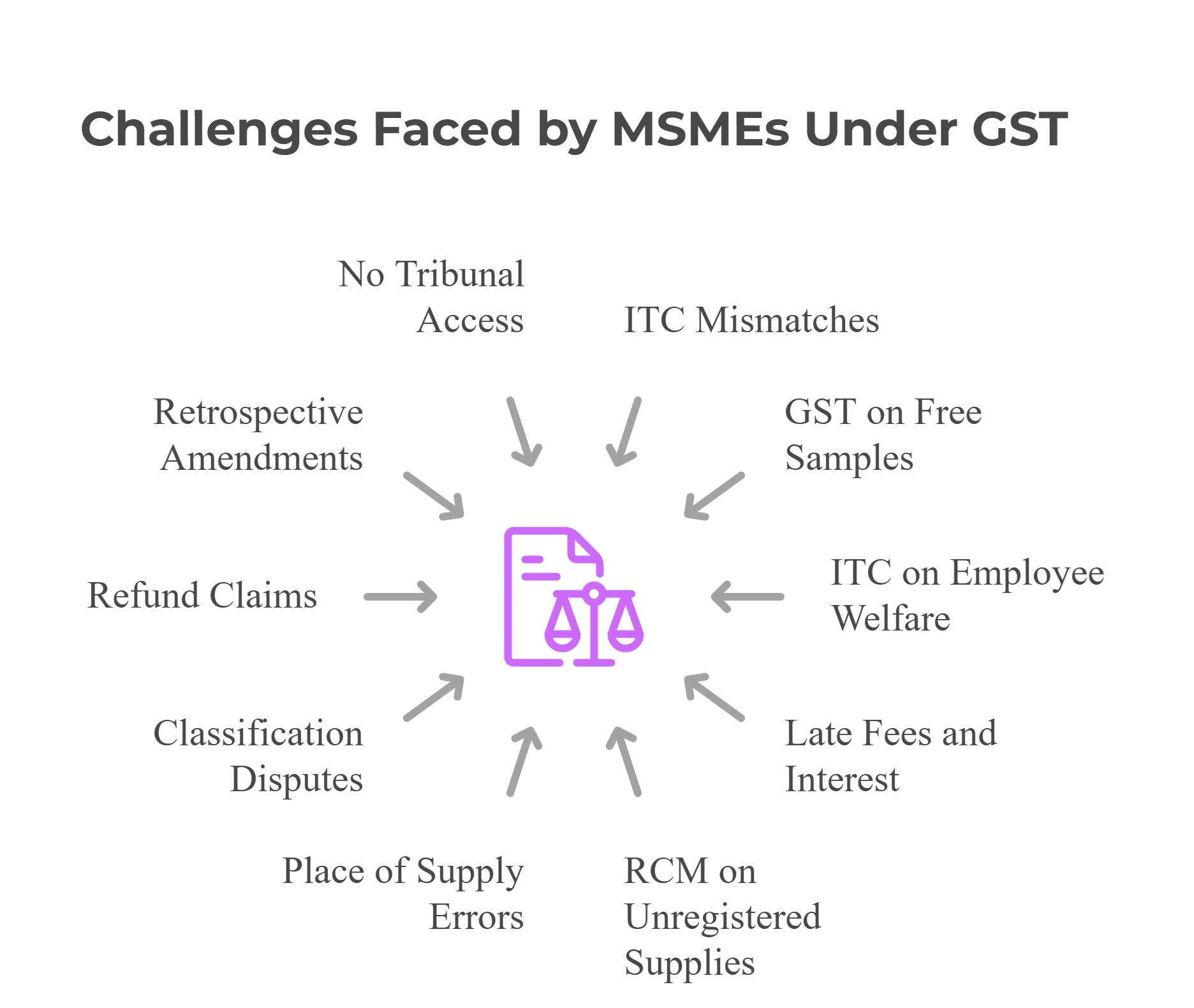

Top 10 GST Litigations and Issues Faced by MSMEs — 2017–2025

Opportunities and Policy Recommendations

After 8 years, GST is ripe for its next phase. Here are key reforms experts are calling for:

1. Rationalization of Rate Structure

Currently, GST has multiple slabs—0%, 5%, 12%, 18%, 28%—plus special rates like 0.25%, 3%, and 1%.

Proposed:

- Move towards 3-rate system (e.g., 5%, 15%, 28%)

- Reduce classification disputes

- Simplify compliance, especially for MSMEs

“GST needs fewer rates, not more exemptions. That’s how you simplify a consumption tax.”

– Fitment Committee Member

2. Inclusion of Petroleum and Other Excluded Items

Key items still outside GST:

- Petroleum products

- Electricity

- Alcohol for human consumption

- Stamp duty

- Vehicle tax

- Property tax

3. Simplifying Returns and Compliance

Too many forms are currently required: GSTR-1, 3B, 4, 5, 6, 7, 8, 9, 9C, etc.

Proposed changes:

- Introduce smart invoicing → auto-populate returns

- Eliminate unnecessary returns (e.g., GSTR-1 if e-invoicing is universal)

- Allow editable auto-populated returns

- Reduce need for auditor certifications for compliant taxpayers

4. ITC Reform and Cross-Government Settlement

Input Tax Credit remains one of the most litigated topics under GST.

Proposed solutions:

- Universal matching of GSTR-1, 2B, and 3B

- Centralized refund and ITC dispute resolution

- Cross-government settlement when tax paid to wrong govt (e.g., CGST instead of IGST)

5. Large Taxpayer Units (LTUs) and Central Jurisdiction

Industries operating across multiple states are advocating for:

- One GST registration under LTU

- Centralized jurisdiction for audit and assessment

SaaS, logistics, and IT companies stand to benefit the most from this model.

6. Amnesty Scheme Before Tribunal Becomes Active

With GSTAT expected to be operational by late 2025, there’s demand for a limited-period amnesty scheme to:

- Settle pending disputes

- Avoid backlog at the tribunal level

- Provide closure to old litigations

7. Training and Field-Level Awareness

Several GST notices are due to:

- Misinterpretation by field officers

- Ambiguity in circulars

- Inconsistent adjudication

Suggested measures:

- Regular training of GST officers

- Clearer circulars with case examples

- Self-certification model for high-compliance taxpayers

Need a GST Filing Solution That Grows Your Business?

Try floTax — India’s trusted ASP & GSP platform for end-to-end GST compliance.

- File GSTR-1, 3B, 9C with zero stress

- Seamlessly manage e-invoicing, reconciliation, and input tax credit

- Custom-built for MSMEs, manufacturers, and tax consultants

👉 Book Your Free Demo @marcom@wepsol.com